The Nasdaq Stock Exchange, a keystone of international financing, supplies a vibrant system for financiers. This expedition looks into the heart of this electronic industry, analyzing its special attributes, chances, and difficulties.

From its simple starts to its existing standing as a leading exchange, the Nasdaq has actually developed along with technical developments. Today, it gives a structured and obtainable setting for financiers to deal supplies, ETFs, and various other safety and securities. Recognizing the ins and outs of this industry is vital to browsing the globe of supply trading properly.

Secret Functions of the Nasdaq

The Nasdaq identifies itself with a number of vital attributes:

- Technology-Driven System: The Nasdaq’s electronic framework promotes quick purchases and real-time information feeds, giving financiers with up-to-the-second info.

- Diverse Financial Investment Opportunities: A vast selection of firms, from developed titans to ingenious start-ups, are noted on the Nasdaq, supplying financiers varied selections.

- Openness and Law: The Nasdaq runs under rigorous regulative structures, making certain reasonable and clear trading methods.

- Worldwide Reach: The Nasdaq’s international existence attaches financiers worldwide, enabling more comprehensive market involvement.

Recognizing the Nasdaq’s Effect

The Nasdaq’s impact expands past its trading flooring. Its activities form market fads and have a considerable effect on international economic climates. This impact is really felt with numerous aspects:

- Market Belief: Nasdaq’s efficiency typically shows total market belief, affecting financial investment choices around the world.

- Financial Indicators: Adjustments in Nasdaq trading task can be utilized as an indication of the health and wellness of the more comprehensive economic situation.

- Development Center: The existence of ingenious firms on the Nasdaq gas technical developments and financial development.

Browsing the Obstacles: Nasdaq

While the Nasdaq supplies significant chances, financiers need to additionally know possible difficulties:

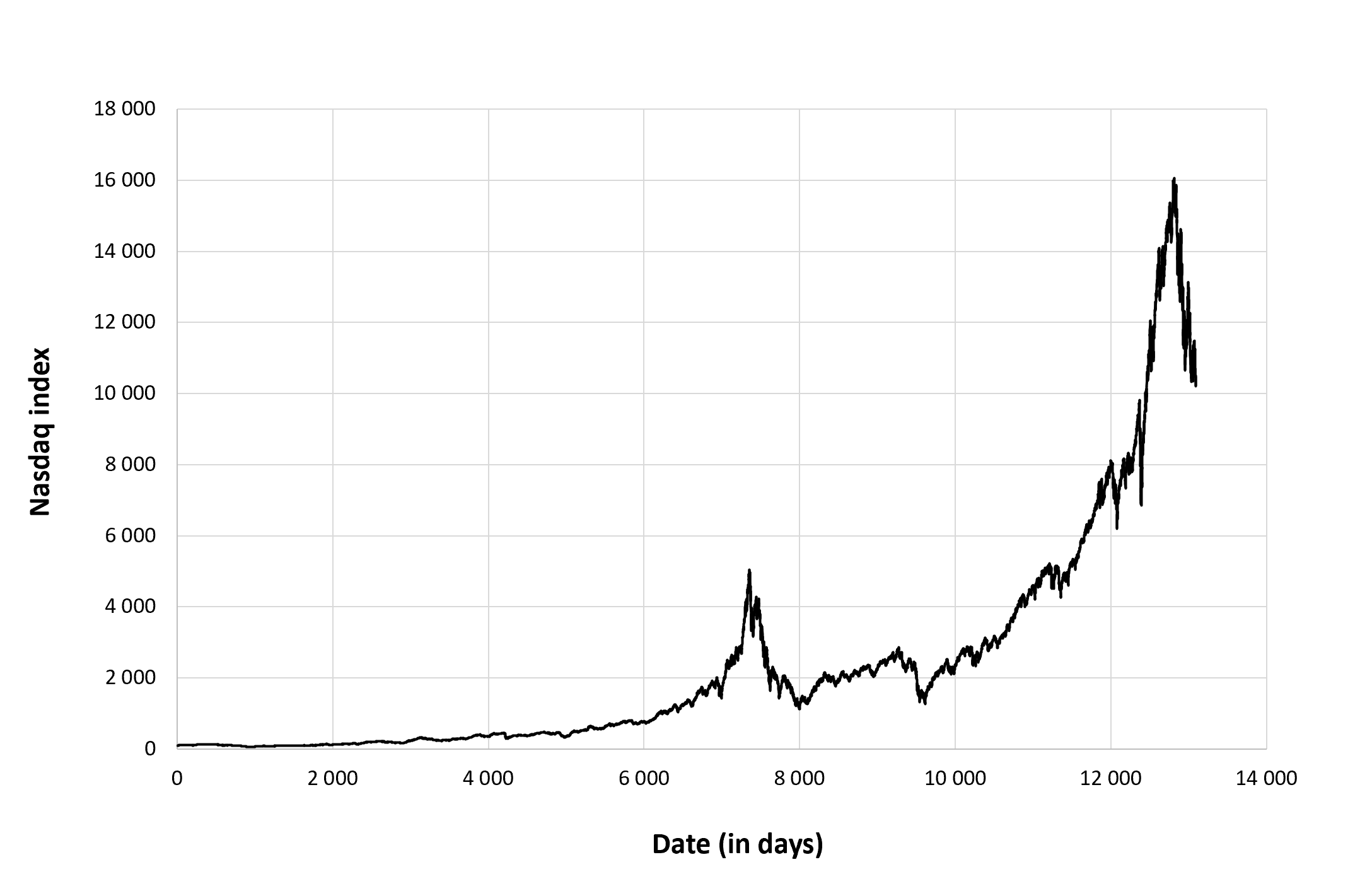

- Market Volatility: Stock exchange, consisting of the Nasdaq, are at risk to changes, requiring cautious financial investment approaches.

- Details Overload: The consistent circulation of information can be frustrating, needing financiers to filter and evaluate info properly.

- Competitors: The affordable nature of the economic market requires caution and critical preparation.

Final Thought: Welcoming the Future of Financing

The Nasdaq’s future is fundamentally connected to the ongoing development of innovation and the transforming demands of financiers. Flexibility and a detailed understanding of the marketplace are vital for success in this vibrant setting.

Resource: simtrade.fr

For additional understandings right into particular fields and firms, check out the Nasdaq internet site:Nasdaq You can additionally gain from involving with economic information resources like the Wall surface Road Journal or Bloomberg, ingrained listed below for a much more detailed understanding of the economic landscape.

.